インプラントは医療費控除でいくら戻るの?申請方法を解説!

先生、インプラントは医療費控除の対象だと聞きました。

いくら戻るんですか?

インプラントで医療費控除を受けた場合、戻ってくる額は所得によって異なります。

具体例を紹介しつつ、

- インプラントは医療費控除でいくら戻るのか

- インプラントで医療費控除を申請するときに必要な書類

- インプラントは高額療養費制度の対象なのか?

についてお話しします!

インプラントで医療費控除はいくら戻る?

医療費控除で戻ってくるお金の目安は、インプラント費用ー10万円(※1)のうち約30%(※2)くらいです。

インプラントの相場は、1本の歯につき約30万〜50万円です。

相場から大まかに計算すると、所得税20%の方が医療費控除を申請すると、所得に応じて6〜12万円くらいはお得にインプラント治療が受けられることになります。

もちろん、所得金額、医療費控除以外の控除の有無などによって金額は変わります。

30%の医療費控除で戻ってくるお金の内訳は、

- すでに支払った所得税の還付金

- これから支払う住民税の減額

の2つです。

このうち、確定申告書後に現金で戻ってくるのは、所得税の還付金です。

これから支払う住民税はまだ払っていないので、現金での還付はありません。

では、インプラント費用が40万円のときに医療費控除で戻ってくるお金が具体的にいくらか、ケース別に3つご紹介します!

【ケース1】

・インプラント費用→40万円

・所得金額→500万円(所得税20%)

⇒還付される所得税額:60,000円

⇒減額される住民税額:30,000円

⇒合計:90,000円(※3)

【ケース2】

・インプラント費用→40万円

・所得金額→800万円(所得税23%)

⇒還付される所得税額:69,000円

⇒減額される住民税額:30,000円

⇒合計:99,000円(※3)

【ケース3】

・インプラント費用→40万円

・所得金額→1,000万円(所得税33%)

⇒還付される所得税額:99,000万円

⇒減額される住民税額:30,000円

⇒合計:129,000円(※3)

※1 所得が200万円未満の場合は、所得の5%を差し引きます。

※2 所得税の負担割合によって変動します。

※3 所得税の還付金、住民税減額の費用は目安です。所得金額や税、その他控除の有無などにより、金額が変わります。

インプラントに使える医療費控除とは

医療費控除はインプラントだけでなく、以下の治療費や治療にかかる交通費も対象となります。

- インプラント

- 自費の詰め物・被せ物(セラミック、ジルコニアなど)

- 自費の入れ歯(金属床、ノンクラスプデンチャーなど)

- 噛み合わせを治すため、もしくは子どもの矯正治療

- 治療のための交通費(自家用車の燃料費や駐車代金は対象外)

- 各種保険治療

これらの治療にかかった1年間(1/1〜12/31)の治療費が以下の場合、医療費控除を申請することができます。

- 合計が10万円以上

- 所得200万円未満の方は、医療費の合計が1年間の所得の5%以上

会社員で副業や不動産などの収入がない場合、源泉徴収票の「給与所得控除の金額」というのが所得となります。

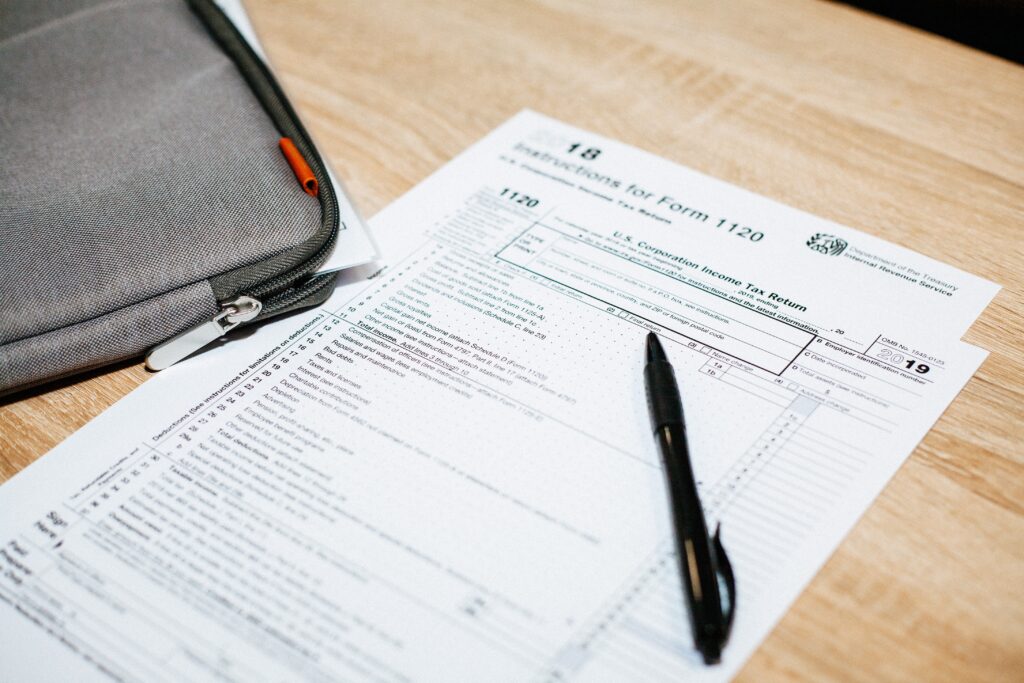

インプラントで医療費控除をするための必要書類

確定申告で医療費控除を受けるには、次の書類を揃える必要があります。

- 確定申告書A、もしくはB

- 国税庁確定申告書等作成コーナー(https://www.keisan.nta.go.jp/kyoutu/ky/smsp/top#bsctrl)からネット経由で作成できます。マイナンバーがあれば、ネットからそのまま提出も可能です。

- 医療費控除の明細書

- 国税庁HP(https://www.nta.go.jp/taxes/shiraberu/shinkoku/yoshiki/02/pdf/ref1.pdf)から書式をダウンロードできます。

- 源泉徴収票

- 12月の年末調整のあとに、会社から発行されます。

- 医療費通知(医療費のお知らせ)

- 保険者か医療機関などの保険請求を元に、被保険者がどのくらい医療費を支払ったかを計算した書類です。

- 健康保険組合によって送付の時期や回数がやや異なります。届かない場合は、組合によってはネットから申請できます。

- 記載されているのは、保険診療分の医療費のみです。

- インプラントや医療費控除の対象となるほかの自費治療費に関しては、領収書などを元に自分で把握して医療費控除の明細書に記載する必要があります。

インプラントは高額医療を使える?

高額医療とは、正確には「高額療養費制度」という以下のような制度です。

医療機関や薬局の窓口で支払った額(※)が、ひと月(月の初めから終わりまで)で上限額を超えた場合に、その超えた金額を支給する制度です。

※入院時の食費負担や差額ベッド代等は含みません。 212,570円を高額療養費として支給し、実際の自己負担額は87,430円となります。

引用:厚生労働省保険局「高額療養費制度を利用される皆さまへ」より

高額療養費制度は、保険診療に対する保険給付の一環として行われるもので、所得税の還付と住民税の減額が行われる医療費控除とは別ものです。

つまり、インプラントは高額療養費制度の対象外となります。

インプラントには、医療費控除を使いましょう。

インプラントの医療費控除での注意点

インプラントで医療費控除を受ける場合は、以下のことに気をつけましょう。

- 医療費控除の申請を必ずする

- 治療にかかる領収書を取っておく

- 交通費は日時・通院先の病院・金額・通院理由を記録しておく

- 審美目的のインプラントは対象外

- クレジット払い、デンタルローンの金利・手数料は対象外

- 個人保険の補填金は対象外

- 医療費控除は最高200万円まで

- 生計をともにする家族は合算して10万円以上なら申請できる(※4)

医療費控除を受けるには、確定申告書で医療費を申告することが一番大切です。

申告しなくても国が自動的に所得税を還付してくれたり、住民税を減額してくれたりする制度ではないので、気をつけましょう。

確定申告書の期間は、毎年2/16~3/15までの1か月間が原則です。

管轄の税務署に直接持ち込む方法や、郵送、マイナンバーカードがあればネットからも申請できます。

医療費控除の申請を忘れてしまった場合は、過去5年分を遡って申請できます。翌年、忘れずに行いましょう。

※4 所得が200万円未満の場合は、所得の5%以上

インプラントには医療費控除を活用しよう!

インプラントは確定申告書で医療費控除を申請することで、治療費の実質負担を下げることができます。

忘れずに確定申告書を行い、所得税の還付と住民税の減税を受けましょう。

365dentistには、あなたのお口の健康と美の参考になるコラムが多数ございます。

また、歯科医院運営オープンチャットでの無料相談やあなたに合った歯科医院選びのお手伝いもしております。

気になる方は、ぜひ遊びに来てくださいね!

関連記事:インプラントは1本いくら?インプラントの費用相場とよい医院の見つけ方

関連記事:インプラントのリスクは?専門医がメリットデメリットを分かりやすく解説!

関連記事:インプラント治療をした芸能人は?芸能人にインプラントが人気なわけ。

365dentist総監修 歯科医師/勝屋友紀子

長崎大学歯学部卒業、〜2018 九州医療センター、2018〜現在 都内歯科クリニック勤務

監修 歯科医師/Naomi

臨床研修終後、都内審美歯科勤務。現在は歯科医師/歯科ライター